Your Dream Experience Waits For: Locate the Best Lease Deals in Glastonbury

Wiki Article

The Ins and Outs of Car Leasing: A Comprehensive Overview on Just How It Functions

Browsing the world of automobile leasing can be a complicated endeavor, needing a firm understanding of the intricacies included. From understanding lease terms to computing repayments and checking out end-of-lease alternatives, there are numerous facets to take into consideration when pondering this financial dedication. As customers progressively choose renting over typical car ownership, it becomes crucial to unwind the nuances of this process to make informed decisions. In this comprehensive guide, we will study the core parts of auto leasing, clarifying the mechanisms that drive this prominent lorry purchase approach.Advantages of Cars And Truck Leasing

When taking into consideration the advantages of vehicle leasing, it is important to examine the economic benefits that come with this option. One considerable advantage is the lower regular monthly settlements connected with leasing compared to purchasing a car. Leasing allows people to drive a more recent cars and truck with reduced ahead of time expenses and lower monthly payments given that they are only funding the vehicle's devaluation throughout the lease term, rather than the entire purchase price. This can be especially appealing for individuals that such as to upgrade to more recent designs often.

In addition, car leasing usually features warranty coverage throughout of the lease, providing comfort against unanticipated repair expenses. Since leased lorries are typically under the supplier's service warranty during the lease term, lessees can prevent the financial burden of major repair work. Leasing might offer tax obligation benefits for business owners that utilize the vehicle for organization purposes, as lease repayments can typically be deducted as a service expenditure. Overall, the economic benefits of vehicle leasing make it an engaging choice for lots of consumers.

Recognizing Lease Terms

Considering the economic advantages of cars and truck leasing, it is essential to understand the intricacies of lease terms to make enlightened choices regarding this automobile financing choice. Lease terms refer to the details problems outlined in the leasing agreement between the lessee (the person leasing the cars and truck) and the lessor (the renting firm) These terms normally consist of the lease period, regular monthly repayment amount, mileage limitations, deterioration standards, and any type of prospective fees or fines.

Computing Lease Repayments

Exploring the procedure of determining lease repayments drops light on necessary monetary factors to consider for people involving in automobile leasing arrangements. Lease repayments are normally established by taking into consideration factors such as the lorry's depreciation, the agreed-upon lease term, the cash aspect (rate of interest price), and any additional fees. To calculate lease payments, one can use the adhering to formula: Monthly Lease Payment = (Devaluation + Money Fee) ÷ Number why not try here of Months in the Lease Term.Maintenance and Insurance Coverage Factors To Consider

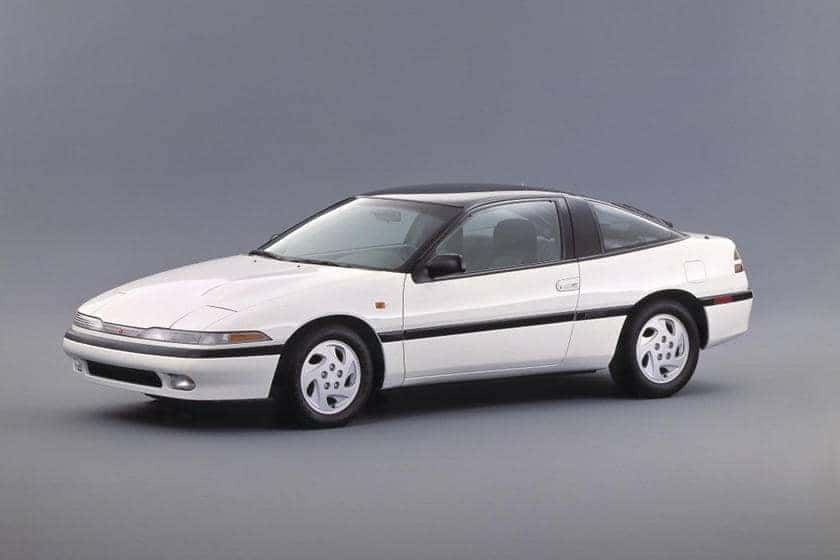

Recognizing the upkeep and insurance policy requirements linked with cars and truck leasing is critical for lessees to ensure the proper care and security of the automobile throughout the lease term. Upkeep responsibilities differ among leasing contracts, yet lessees are generally expected to maintain the producer's recommended maintenance schedule. New Mitsubishi lease specials Windsor.Concerning insurance coverage, all leased lorries must have comprehensive and crash coverage with responsibility limits that fulfill or surpass the renting company's requirements. It's vital to very carefully assess the insurance policy needs laid out in the lease agreement and make certain that the protection is maintained throughout the lease term.

End-of-Lease Options and Refine

As completion of the lease term methods, lessees exist with numerous choices and a specified process for picking or returning the vehicle to go after a different arrangement. One common option is to simply return the vehicle to the lessor at the end of the lease term. Lessees are usually in charge of any kind of excess gas mileage fees, wear and tear fees, and any type of other impressive payments as outlined in the lease arrangement.

An additional option for lessees is to sell the leased automobile for a brand-new lease or purchase. This can be a hassle-free choice for those that prefer to continuously drive a brand-new lorry without the trouble of marketing or returning the existing rented vehicle.

Inevitably, understanding the end-of-lease alternatives and process is vital for lessees to make enlightened choices that straighten with their requirements and preferences. Mitsubishi Outlander lease deals bristol.

Final Thought

Understanding lease terms, computing payments, and taking into consideration upkeep and insurance coverage are crucial facets of the leasing process. Additionally, recognizing the end-of-lease choices and procedure is important for a smooth transition at the end of the lease term.Because leased vehicles are usually under the supplier's guarantee throughout the lease term, lessees can check that prevent the economic problem of significant repair work. Lease terms refer to the details conditions detailed in the leasing contract in between my review here the lessee (the individual renting the vehicle) and the lessor (the renting business)One crucial element of lease terms is the lease duration, which is the size of time the lessee concurs to rent the car. New Mitsubishi lease specials Windsor. Lease settlements are usually figured out by thinking about aspects such as the lorry's depreciation, the agreed-upon lease term, the money aspect (passion price), and any kind of added charges. To compute lease repayments, one can use the complying with formula: Regular monthly Lease Settlement = (Devaluation + Finance Fee) ÷ Number of Months in the Lease Term

Report this wiki page